Introduction

In 2025, finance and investment apps are smarter, safer, and more accessible than ever. With AI-driven insights, real-time analytics, and personalized tools, these apps empower users to manage money, invest wisely, and achieve financial freedom. Here are the top 5 finance apps of 2025.

1. Revolut X – Next-Gen Digital Banking

Category: Banking & Payments

- Multi-currency accounts with instant exchange

- AI budgeting tools with smart savings suggestions

- Commission-free crypto and stock trading

- Real-time fraud protection with biometric security

- Global money transfers in seconds

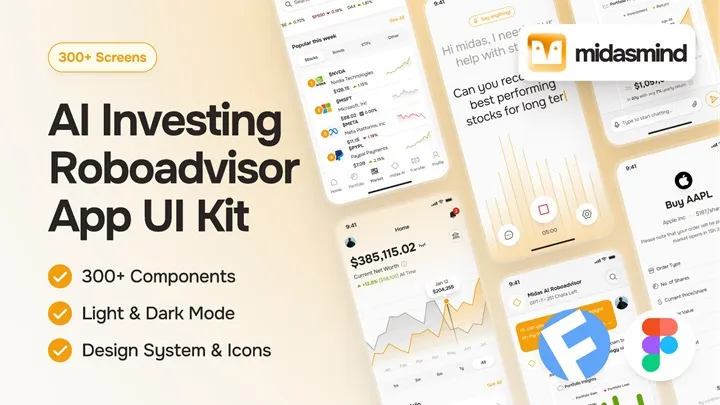

2. WealthMind – AI Investment Advisor

Category: Investing

- AI-driven portfolio management

- Personalized risk analysis and asset allocation

- Real-time stock and crypto market insights

- Automated rebalancing for long-term gains

- Integration with major exchanges and brokers

3. FinGuard – Secure Money Management

Category: Finance Security

- Real-time fraud detection alerts

- Identity theft protection with dark web monitoring

- Secure card management with instant freeze/unfreeze

- AI-powered suspicious transaction detection

- Encrypted cloud storage for financial documents

4. BudgetBee – Smart Budgeting App

Category: Personal Finance

- Automated expense tracking by category

- AI-powered savings goals and debt repayment plans

- Bill reminders and payment automation

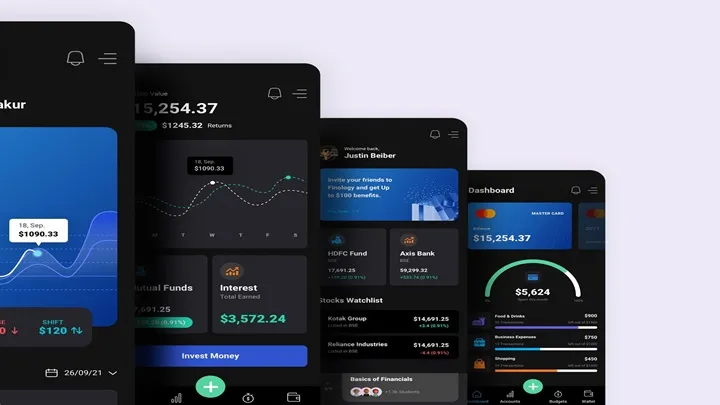

- Visual dashboards for clear financial insights

- Family sharing for household budgets

5. CryptoNest – Future of Digital Assets

Category: Cryptocurrency & Blockchain

- Secure multi-wallet crypto management

- Real-time analytics and AI price predictions

- NFT marketplace integration

- Staking and passive income opportunities

- Cold storage compatibility for max security

Conclusion

The top 5 finance apps of 2025—Revolut X, WealthMind, FinGuard, BudgetBee, and CryptoNest—are revolutionizing money management and investing. With AI, automation, and enhanced security, financial freedom is now within reach for everyone.